美债总量在六个星期里增1.5万亿美元 联储买下了其中9成

美国国债总量在六个星期里增加了1.5万亿美元,联储买下了其中9成

译者 王为

文中黑字部分为原文,蓝字部分为译文,红字部分为译者注释或补充说明

US National Debt Spiked by $1.5 trillion in 6 Weeks, to $25 trillion. Fed Monetized 90%

by Wolf Richter

I’d never imagined I’d ever see this sort of spike, though in recent years I added an upward arrow with “Debt out the wazoo” to my charts, not realizing just how factually accurate this technical term would become.

我从未想过有朝一日会见到美国国债总量出现如此快速的增长,尽管在最近几年里我在上面这张美国国债总量走势图中加上了一个向上的箭头,并加了一个“债务增长刹不住闸”的绿色标签,但我并不清楚这个词如何才能从一个专业术语变成现实。

The US gross national debt – the total of all Treasury securities outstanding – jumped by $1.05 trillion with a T in the four weeks since April 7 and by $1.54 trillion in the six weeks since March 23, to $25.06 trillion, the Treasury department reported today.

据美国财政部5月6日公布的数据,美国联邦政府的总量,即尚未到期的美国国债的余额在4月7日以来的四个星期里跳增了1.05万亿美元,在3月23日以来的六个星期里跳增了1.54万亿美元,最新值为25.06万亿美元。

Those trillions are whizzing by so fast it’s hard to even seen them. WOOSH… What was that? Oh, just another trillion. The flat spots in the chart are the periods when the debt bounced into the debt ceiling. Yeah, those were the days!

这些债务增加的速度之快以至于很难让人及时感知到,嗖地一下。。。咋回事?又涨了一万亿美元,下图中的那些直线说明美国国债总量触及到限额,你没看错,几天之内美国国债就增加了这么多!

I’ve been lamenting and lambasting the stupendous growth of the US national debt since 2011, the beginning of my illustrious career as a gnat in the big world of financial media. And through all these years, I’d never imagined that I’d ever see this sort of spike in the US debt, though in recent years I’ve been adding an upward arrow and the green label “Debt out the wazoo” to these charts, not realizing just how factually accurate this technical term would become.

2011年以来我一方面在痛惜另一方面又在谴责美国国债总量的快速增长,正是在这一年我这个沧海中之一粟开始有声有色地走上了自己的财经媒体之路。这些年来,我从未想过有朝一日会见到美国国债总量出现如此快速的增长,尽管在最近几年里我在上面这张美国国债总量走势图中加上了一个向上的箭头,并加了一个“债务增长刹不住闸”的绿色标签,但我并不清楚这个词如何才能从一个专业术语变成现实。

The US debt was even surging at an accelerating rate during the “Best Economy Ever,” when there should have been a surplus and a reduction in the debt, so that the government can go into debt during bad times.

美国债务总量甚至在“从未见过的最佳经济增长时期”里也呈加速增长态势,经济好的时候财政应该出现盈余并且债务总量应该减少才对,这样在经济不好的时期政府就可以借债度日。

I wrote back then, for example on February 19, when the debt had spiked by $1.3 trillion over the past 12 months to $23.3 trillion: “But these are the good times. And we don’t even want to know what this will look like during the next economic downturn.”

比如,在2019年2月当美国国债总量在过去十二个月里新增了1.3万亿美元达到23.3万亿美元以后,我曾写过,“现在正是美国经济形势不错的时期,我们甚至不想知道在未来的经济下行期间美国的债务形势会变成什么样。”

Whether we want to know it or not, we now know it and cannot un-know it.

不管我们当时是否想知道,现在我们已经知道了,而且不能假装不知道

And we didn’t even have to sit on the edge of our collective chair for long for that next economic downturn to arrive. It’s more than just a downturn. It’s the big one. The nightmare has become a reality. And waking up or looking away no longer helps.

我们甚至不需要花上很长时间坐立不安地等待下一场经济下滑的到来,眼前已经不是经济下滑了,而是大衰退了。噩梦成了现实,等你醒来的时候环顾四周才发现谁也指望不上。

The government has now signed into law a series of stimulus packages totaling $2.8 trillion or thereabouts.

联邦政府如今签署法律,出台了总额约为2.8万亿美元的一系列经济刺激举措。

Phase 1: $8 billion, enacted on March 6. To fight the spread of The Virus

第1阶段:80亿美元,3月6日开始实施,旨在抗击新冠疫情的扩散。

Phase 2: $100 billion, enacted on March 18. Tax credits for employers offering paid sick leave, plus increases to unemployment benefits and food assistance.

第2阶段:1000亿美元,3月18日开始实施,为雇主企业提供税收优惠以资助给病假期间的员工开工资,并增加失业救济和食品补贴的金额。

Phase 3: $2.1 trillion, enacted on March 27. Largest stimulus package ever, dwarfing the 2009 stimulus package of a mere $800 billion. The CARES Act includes provisions to bail out the investors of Corporate America and financial markets more generally, directly and also indirectly via the Fed’s Special Purpose Vehicles to which taxpayers provide the equity capital to take the first loss.

第3阶段:2.1万亿美元,3月27日开始实施,为有史以来最大的经济刺激举措,远超2009年时总额仅为8000亿美元的纾困方案。这个名为CARES的法案包含一些条款,通过美联储设立的特殊目的实体直接或间接地为美国企业以及美国金融市场上的投资者提供更广泛的纾困,美国纳税人为这些特殊目的实体提供了资本金并首当其冲承担了风险。

The package includes extra unemployment benefits, free money for taxpayers and retirees, funds for the healthcare system, some money for “small businesses” under the Payroll Protection Program that quickly tended to flow to well-connected not-so-small businesses, etc. etc. This is a huge massive complex bill with lots of goodies in it.

这些纾困措施包括提供额外的失业补助,给纳税人和退休人士直接发钱,给医疗体系提供资助,并按照收入保障计划的安排为小企业提供资金,这样就可以确保资金能够流入与小企业业务关系紧密的非小型企业手里,这是一个夹带了很多好处的超大型综合经济救助法案。

Phase 3.5 or 4: $484 billion, enacted on April 28. Refills the PPP and the Economic Injury Disaster Loans, plus sends money to health care providers, hospitals, and for coronavirus testing.

第3.5阶段或称第4阶段:4840亿美元,4月28日开始实施,为收入保障计划和经济救灾贷款补充弹药,此外给保健服务提供商、医院和新冠病毒检测等拨款。

Phases 5 – umpteen: to be enacted soon.

第5阶段:救助无限额,即将实施。

So about $2.7 trillion for now. At first, there was a mad scramble of lobbying to get all the favorite provisions into the bills. Now a mad scramble has ensued to siphon out this money. Billionaires and millionaires will be printed, especially if they’rewell-connected.

因此到目前为止,纾困计划的总规模约为2.7万亿美元。纾困计划酝酿之初,各路游说团体一哄而上,都想把对自己有利的条款塞进纾困法案里。接下来,各路人马都想把这些救济资金踹进自己的腰包。亿万富翁和百万富翁们将批量诞生出来,尤其是如果这帮人手眼通天的话。

And lobbyists are highly motivated to get even more stimulus packages through Congress. This is a once-in-a-life-time opportunity.

游说人士强烈希望美国国会通过更多的经济刺激法案,这可是一辈子都很难碰上一次的好机会。

And while these trillions sally forth into the wild yonder, tax revenues are collapsing. The difference has to be made up with borrowing. The Congressional Budget Office has jacked up its estimate for the fiscal 2020 deficit to $3.7trillion. There are only five months left in this fiscal year. So these trillions are going to have to be borrowed in a hurry.

虽然这几万亿美元被政府潇洒地抛了出去,但税收却遭遇了崩溃式下跌,收支之间的差额只能用增加借贷的办法来解决。美国国会预算办公室将2020财政年度的预算赤字估算值向上修正到了3.7万亿美元,本财年仅剩下五个月,因此美国政府得赶紧把这几万亿美元的债给借了。

Fed steps up to the plate, monetizes 90% of the additional debt.

美联储闪亮登场,吃掉了9成新发行的美国国债

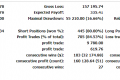

From March 11 through its balance sheet released last Thursday, the Fed added $1.39 trillion in Treasury securities to its assets. Over the same period, the Treasury Department added $1.54 trillion to the outstanding debt. In other words, the Fed has – indirectly, as is the iron rule in the US – monetized 90% of this additional debt. We’re living off printed money, pure and simple.

上周四公布的数据显示,3月11日至今美联储增持了1.39万亿美元的美国国债, 而美国财政部在此期间新发行了1.54万亿美元的国债。也就是说,美联储间接地货币化了这些新发的美国国债,在美国这可是一条颠扑不破的铁律。美国现在纯粹就是靠印钞活着,就是这么一回事。

But this was heavily frontloaded, with the Fed buying $1.1 trillion in Treasuries over the first 3.5 weeks. The Fed has since backed off. Last week, it bought only $62 billion. And it looks like the market will be tasked to digest more of this debt.

但由于在纾困计划实施的前三周半买走了1.1万亿美元的美国国债,联储有点用力过猛,从那之后后劲有点跟不上了。上周,联储只买了620亿美元的国债,现在看起来需要靠市场自己消化这些新发的国债了。

本文地址:https://www.waihuibang.com/currency/usd/146631.html